Insights on Innovations, Evolutionary Shifts, and Secular Trends

Podcast: The Business Brew - Investing in Innovation

In this podcast, Evolutionary Tree Founder Thomas Ricketts talks with Bill Brewster, host of the well-respected podcast The Business Brew, about the power and impact of innovation on industries, the economy, and investing.

Innovation Investing Chartbook

As thought leaders in the area of innovation investing, we believe it’s important to make the case for innovation-focused investing. This Innovation Investing Chartbook brings our thought leadership to life, with 20+ charts we’ve created and assembled to demonstrate the advantages that quality innovation-focused asset managers have over traditional growth and value managers.

The Rise of Secular Innovators

Secular Innovators create a series of market-defining innovations, which drive multi-year secular trends over time. In this thought piece, we explore what we call a new apex species of Secular Innovators and how they can sustain growth and leadership over time.

Webinar: Innovation Investing - Challenges & Opportunities

Interested in learning what inflation and higher rates could mean for innovative growth companies? We invite you to access our video call (recorded on May 25, 2021) to learn how the recent “reopening trade” may have largely played out, while innovation and secular growth may continue long term.

The Power of Evolution to Create Long-Term Opportunity

How can investors harness accelerating change for long-term value creation? In this thought piece, we explore possible answers to this question.

Webinar: The Outlook for Innovation

Interested in gaining equity exposure to truly innovative companies? In this broadcast, we discuss the outlook for innovation across the equity landscape and much more.

Specialness & the Power of Culture

Does company culture matter to investors? Strong culture can result in heightened employee productivity, higher customer satisfaction, and improved financial performance. We cover the power of culture within companies and more in this thought piece.

Webinar: Citywire World of Boutiques Presentation on Innovation Investing

Why do investors often focus on growth instead of innovation? In this video, we explain why innovation investing is a solution for navigating a rapidly-changing economy.

Webinar: Innovation Investing - Navigating Accelerating Change in an Evolving Economy

In this presentation, Thomas Ricketts, CFA, President and Portfolio Manager of Evolutionary Tree, discusses the fast-changing economy and why a combination of innovation and evolution tends to position leading innovators for sustained growth. He also shares perspectives on why markets struggle to efficiently price innovation, secular trends that are creating opportunities, and examples of product and industry evolution. Further, Mr. Ricketts provides insight into the unique Evolutionary Tree research process, with company analysis examples and much more.

Guidance for Navigating the Bear Market of 2020

On March 20, 2020, within days of the first quarter market bottom, we penned an in-depth letter to our clients and partners. This client letter included eight main viewpoints intended to help our clients navigate an economy in turmoil. By providing this letter publicly, we believe it gives a window into how we provide long-term perspective to our clients and partners, which is part of our client-focused mission.

Audiocast: Bear Market Update - Navigating an Economy in Turmoil

Hear our bear market update with Evolutionary Tree CIO Thomas Ricketts for perspective on secular growth trends and navigating a bear market.

The Digital Transformation of All Businesses and Industries

Most new technologies that come along are mere tools, incremental in impact to a given company or industry. There are certain types of technologies, however, that have the power to transform companies and even entire industries. Academics call these technologies “general-purpose technologies.” Their development and evolution have often been the underlying engine of economic development and productivity jumps. This thought piece focuses on the current general-purpose technologies transforming all industries today, collectively described as Digitization.

The Rise of Advanced Biotechnology in the Age of Genomics

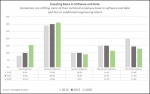

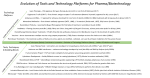

No industry better illustrates the idea of the innovation frontier and the impact of the expansion of scientific knowledge and its driving influence on the evolution of technology than biotechnology. In 1973, Herbert Boyer and Stanley Cohen (at UCSF and Stanford University, respectively) invented the basic genetic engineering techniques enabling the creation of recombinant biotech therapies such as insulin. Since then, the biotech industry has seen tremendous progress on many fronts, with a series of breakthroughs in the treatment of various diseases, some of which we touch on below.

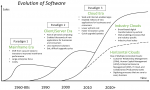

How Software-as-a-Service (SaaS) Speeds Up Innovation Cycles

One of the most important trends in the technology sector is the shift from on-premise software to software-as-a-service, or SaaS, for short. The key difference between the two technologies is on-premise software is installed and run at the client’s physical location, while SaaS is delivered from the software vendor to the client over the Internet via a web browser. This change in architecture has created numerous growth opportunities for forward-thinking, innovative companies and has given rise to a new class of software leaders. At the same time, it has challenged the previous generation of on-premise providers to make the jump to the new architecture. Navigating the shift to a new paradigm is often a difficult transition, and legacy vendors have struggled to adapt, leaving the door open for leading SaaS innovators.